For a traditional mortgage, just be sure to bring an advance payment towards the assets you find attractive. The latest downpayment count hinges on the money you owe therefore the certain financing you will get.

If you are a down-payment to possess a traditional financing can be as reduced since 3%, the majority of people opt to set closer to 20% down, because lowers their monthly homeloan payment and you can reduces the count they should shell out when you look at the appeal through the years. Should you choose an adjustable-rates financial, make an effort to shell out about a great 5% down-payment, whatever the loan you receive.

You I

PMI, or private mortgage insurance policies, needs if you wish to use a conventional home loan so you’re able to buy your assets with lower than 20% off. If you were to default in your loan, personal home loan insurance policies handles the financial institution.

The price you only pay to possess PMI could be influenced by what variety of mortgage you select, exactly what your credit score is actually, and just how a lot of a down payment you place off. You could potentially generally include PMI towards mortgage payment, or you can choose pay for PMI within the settlement costs. Speak with their financial expert to find the most practical way to help you pay for PMI in case it is expected.

After you’ve 20% security of your property, the new PMI is easy to remove from your own home loan without having to re-finance. If the home prices increase, you might query to own your residence appraised to see if you really have achieved sufficient guarantee to eliminate the latest PMI on your own household.

Your credit rating

Your credit rating is an essential parts in terms of obtaining a traditional home loan. To have conventional money getting very first-go out homebuyers, attempt to https://elitecashadvance.com/loans/loans-for-immigrants/ provides a credit history of at least 620. People with higher fico scores are typically able to be eligible for all the way down interest levels and a lot more useful financing terms and conditions.

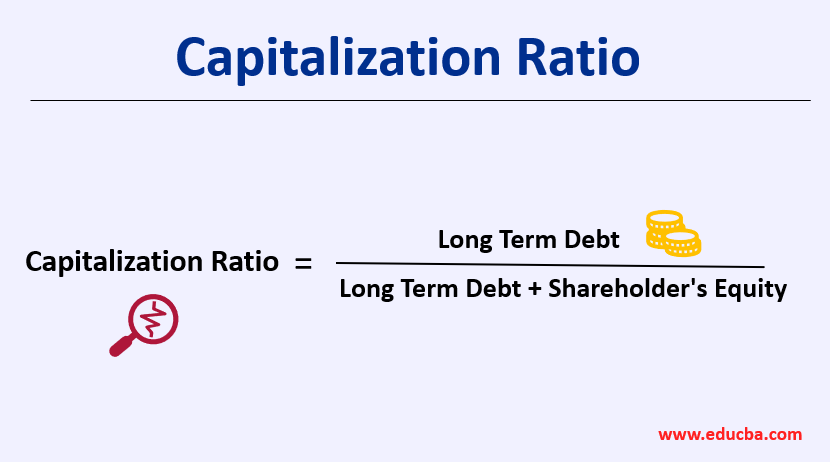

Your debt-to-Income Proportion

Your debt-to-money ratio is when much personal debt you pay all the times in the place of how much cash money you have arriving. Thus giving lenders ways to know if you will be able to handle the additional price of home financing per month. To calculate your DTI, you place upwards all of the lowest monthly premiums towards the the financial obligation and you may split it by the total revenues monthly. To find a traditional mortgage, the DTI generally speaking need to be below 50%.

How big Your loan

How big is your loan is important of trying to find a normal mortgage. Although this count transform per year, new standard compliant financing restrict starting 2024 is actually $766,550. Keep in mind that loan constraints can be higher in elements in which home prices are more than mediocre.

There was a beneficial 10-step process to get an interest rate which have Griffin Money. I work tirelessly to express the method, even as we keep in mind that protecting home financing can seem to be daunting. The brand new ten-step process for finding a normal financing since an initial-go out domestic visitors is as follows:

- Plan a development fulfilling to speak with a home loan professional inside the buy more resources for your home loan possibilities and you can qualifications. This will occur in person, about, or for the mobile.

- You will sign up sometimes during the time of your discovery fulfilling otherwise eventually later on. You can get the loan expert assistance you contained in this procedure if you decide Griffin Money will be your lending company.

- Everything you need to would for step three are supply the mortgage pro permission to protect the pace you were quoted when you applied for your own mortgage.

Leave a Reply