Making an application for a beneficial HomeReady Financial

- Contrast Loan Provides: Start with contrasting the advantages away from good HomeReady mortgage which have most other financial options. Observe that while HomeReady makes it possible for low down payments, interest levels is greater than particular old-fashioned funds. Taking a look at such items helps https://paydayloanalabama.com/center-point/ determine if advantages exceed the costs.

- Look at Qualifications Standards: Understanding the methodology within the determining income eligibility is vital. HomeReady mandates income limits, credit rating standards, and you will a great homeownership studies movement. For many who satisfy such qualifications, you’re on the proper track. Otherwise, seeking to recommendations of a mortgage mentor is a great second step.

- Compare Lenders: While the HomeReady program was a fannie mae step, funds aren’t provided individually because of the Fannie mae. You will need to look for an external financial-such a neighborhood bank or an on-line lender. Consider, specific loan providers may well not promote these types of mortgage, it is therefore important to look around.

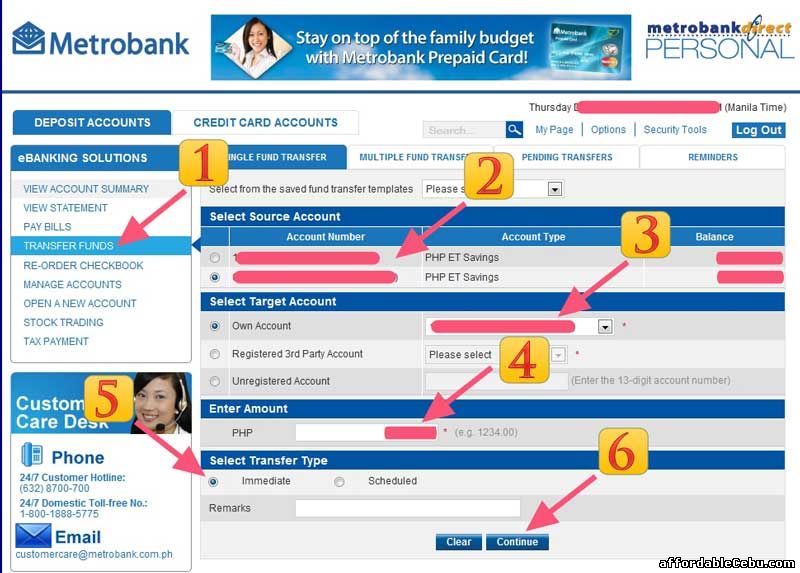

- Complete Your loan Software: The application concerns filling out models and you may submitting files, such as evidence of money and you may tax returns. Electronic platforms you are going to give quicker running due to real-date monetary research verification.

- Await Loan Acceptance: Immediately following applying, lenders glance at your financial balance and creditworthiness. Delivering recognized will bring details just like your interest and you will mortgage amount, paving how to have home browse otherwise and make a deal. In the event the app isn’t successful, explore other home loan choice together with your mentor.

Understanding the full-range regarding home loan selection is key to have prospective people. A couple popular possibilities with the HomeReady home loan, hence uses a methodology during the deciding money qualifications, try FHA loans and you will Freddie Mac’s Family Possible program. Each also offers line of pros and you will provides additional borrower demands.

Researching HomeReady Financing having FHA Funds

While you are HomeReady money help in homeownership identical to FHA funds, it focus on different borrower profiles. When you’re qualified to receive an effective HomeReady mortgage, you can also qualify for an FHA mortgage. But exactly how are you willing to decide which one is more desirable for your position?

FHA funds was basically helping renters since the 1934, specifically those with minimal deposit information. The newest FHA demands at least downpayment out of step three.5%, marginally more than HomeReady’s 3%. These loan programs, even if similar in the downpayment, disagree rather various other portion.

When to Opt for an FHA Financing Over HomeReady

FHA money are perfect for consumers that have straight down credit ratings. You could secure a loan which have a FICO get given that reasonable since the 580 and you can good 3.5% advance payment. Also individuals with ratings ranging from five hundred and you will 579 could possibly get qualify having a good ten% deposit. This new FHA’s backing enables loan providers giving good conditions to those which have all the way down borrowing.

Advantages of choosing HomeReady Over FHA

HomeReady stands out along with its self-reliance for the earnings verification. Lower-earnings borrowers can use having co-individuals if you don’t tend to be extra cash, particularly rent away from an excellent boarder, without needing brand new tenant on application for the loan. Although not, proof of one 12 months from cohabitation towards tenant is needed.

A life threatening advantageous asset of HomeReady, becoming a normal mortgage, is the power to cancel personal financial insurance (PMI) since the loan equilibrium falls to 80% of your own home’s value, probably reducing monthly installments. Conversely, FHA fund manage mortgage insurance on the longevity of the borrowed funds unless good ten% down-payment is created.

It is important to keep in mind that HomeReady needs individuals to have an enthusiastic income that does not exceed 80% of area’s median money.

HomeReady in the place of House It is possible to

- Allow a good step 3% deposit.

- Put a living maximum in the 80% of your area’s median money.

- Try friendly into the co-consumers.

Although not, the house You are able to system normally demands the absolute minimum credit history from 660, whereas HomeReady is normally offered to people with a great FICO score of 620 or even more.

Leave a Reply