Contrast Loan providers

One thing to carry out when you are shopping for any type regarding financing are check around and you can contrast additional lenders. All of the bank gives different costs, charge, and other enjoys due to their finance. By firmly taking committed to take on a few different possibilities, you will probably find one that is providing a better bargain.

Gather Your data

- Individual identity, and Social Defense amount

- Money information and you may employment record

- Household files, together with a recent mortgage statement

- Evidence of homeowners’ insurance

- Possessions taxation expenses

- Details about almost every other outstanding expense

- A summary of their possessions and you can membership comments

Before applying to possess good HELOC, take some time to check the credit and make certain you to everything you looks accurate.

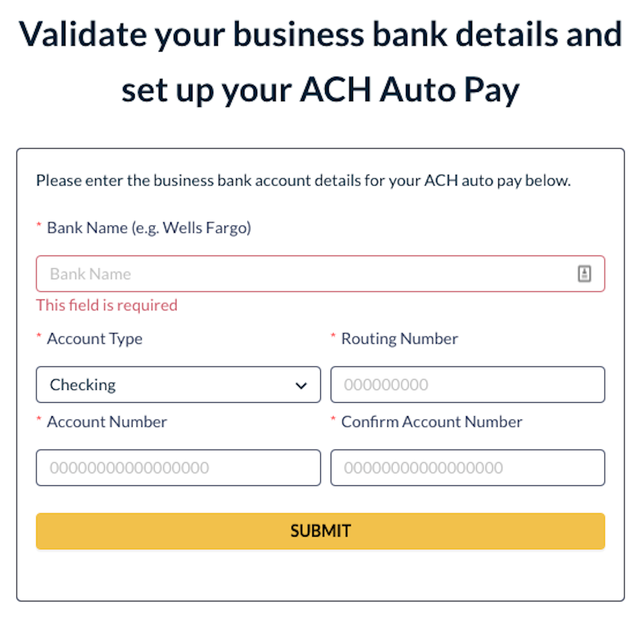

Submit an application

Shortly after you happen to be ready, you could potentially make an application for an excellent HELOC. Render all of the asked files and you will work on your bank to help you be certain that the information in your home well worth, a job and money records, and respond to any kind of concerns they might have.

Assessment

If your bank approves your to own an excellent HELOC, they are going to want to confirm that you reside well worth adequate to properly keep the mortgage. They are going to buy an assessment of your property to choose its value. Caused by so it appraisal can enjoy a task into the deciding just how much you can borrow with your HELOC.

Closing

Should your assessment returns and you will demonstrates to you have sufficient collateral, the next step is closing. It is possible to indication all the mortgage files and you will records. You will find three days in order to cancel the fresh HELOC for many who improve your brain.

Make use of your Credit line

Following around three-go out prepared months, the HELOC are theoretically open and you will initiate accessing the newest personal line of credit. There are a suck several months-usually 10 years-at which to view the funds as required. During this period, you will begin making monthly obligations to add a fraction of the principal (the quantity your acquire) in addition to accrued focus.

Alternatives so you’re able to HELOCs

HELOCs is actually you to option for residents looking to get cash-out of their house, but you’ll find choices to consider.

Household Security Loan

A house security financing will bring a one-go out shipments from funds you to property owners can use to own such things as purchasing a massive scientific costs, capital do-it-yourself, or merging debt.

Household security fund are generally fixed-price funds and therefore are ideal for you to-go out expenditures. They’re not the best choice for situations where you will need to help you withdraw loans several times.

Cash-Out Re-finance

An earnings-aside re-finance lets you refinance all of your current financial or take particular of your own guarantee from your home given that cash. Such as for example, for many who owe $200,100000 on your financial and also a home value $3 hundred,100, you can refinance your own home loan with a brand new, $250,100 mortgage to exchange the existing mortgage and just have $50,000 in the bucks.

Including domestic equity funds, cash-aside refinances are ideal for one to-go out costs as they render a single-go out commission out of money. Yet not, while they alter your whole home loan, they tend to be better if you’re able to re-finance to less rates otherwise want to exchange an adjustable-price home loan to have a predetermined-price you to.

Contrary Financial

A face-to-face home loan lets home owners ages 62 otherwise more mature change the home guarantee on a source of income throughout old age. This type of money tend to be more advanced than just HELOCs or other collateral-founded money, so it’s crucial that you analysis due diligence before getting you to definitely.

Overall, they truly are a good choice for more mature homeowners americash loans Hartford who are in need of so you’re able to supplement their money but aren’t used in a number of other activities.

Frequently asked questions (FAQs)

How much cash you can buy which have a great HELOC is based in your domestic guarantee. Specific banking institutions allow you to get good HELOC of up to 90% of home’s really worth.

Leave a Reply