Lenders every have varying criteria getting a property collateral loan. Although not, nearly all of them have a tendency to consider your credit history, the debt-to-income ratio, and how far security you may have of your property.

If you have a credit rating out-of 700 and you can more than, a financial obligation-to-money ratio lower than 50%, and you will that loan-to-worth proportion below 80%, you’ll have nothing wrong qualifying having a home security loan. But not, because for every financial kits its chance conditions, you could find you to definitely certain lenders much more flexible than others.

How to get a home security loan?

Bringing property security mortgage for debt consolidation reduction involves several steps. You’ll want to make certain you qualify because the a good borrower, your property is eligible, and you satisfy various other requirements of the financial.

Individual strategies can vary according to the lender you choose, but you will encounter many same steps regardless of and that financial you select. The following is a list of the methods we offer your proceed through inside the scraping your residence guarantee to have debt consolidation reduction:

- Store loan providers to find the best rates, fees, mortgage software, and you may words readily available

- Fill out an application

- Indication original disclosures

- Deliver the lender with people files must promote an initial mortgage decision

- Plan any third-group inspections required by the lending company

- Supply the financial that have people files required by underwriting

- Agenda a scheduled appointment that have good notary so you’re able to indication last mortgage documents

- The mortgage is actually funded after the lender receives the executed loan files

Shop loan providers

Before you choose a certain bank, you should store costs which have at the very least a small number of organizations in lieu of refinancing their financial with similar lender you happen to be currently using. Other loan providers offer individuals combinations interesting cost, costs, loan software, and financing conditions. Shopping rates which have several loan providers provides you with insight into which home loan is the better one for you.

Of several borrowers focus on the interest rate and charge charged but don’t forget concerning the fine print from the loan conditions. Some fund could have most will cost you particularly pre-percentage penalties, membership inactivity fees, or lowest draw quantity which will ensure it is difficult plus costly for you to use.

It is also helpful to understand reading user reviews concerning the financial as it offers sense as to what your own feel would be such as. Exactly how educated have been the loan officers? Was basically it clear in regards to the process? Did it experience any invisible charges?

Submit an application

Once you’ve selected a lender, you could fill in a software for those who have not yet done this currently. You will have to provide the financial with some basic information about on your own, the home, and you will what kind of loan you are looking for. The financial institution will you want your own consent so you’re able to conduct a difficult borrowing eliminate.

Signal original disclosures

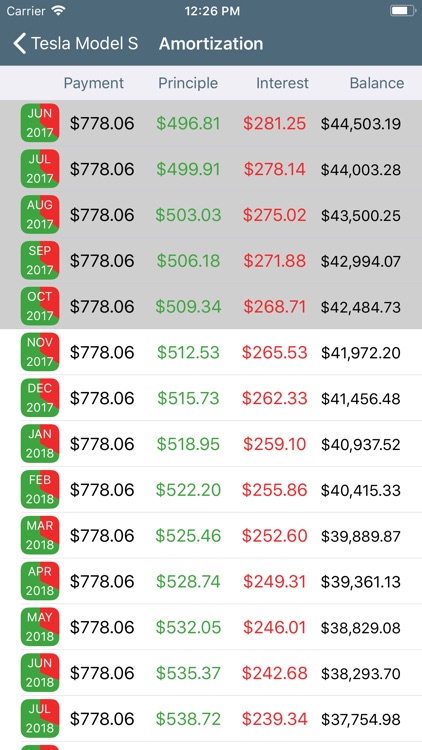

Once you have filed the program, some loan providers will need you to definitely speak with financing administrator, and others deal with this step automatically. After you have confirmed the type of financing you would like, just be sure to indication disclosures one to information new regards to the loan you have removed. Such disclosures will have information about the interest rate, fees, and specifics of mortgage terms and conditions payday loan Columbine Valley eg how monthly installments was computed and you may whether you will find one pre-commission punishment.

Deliver the financial which have first supporting records

Shortly after disclosures have been signed along with provided to flow pass, the lender usually generally speaking consult documents away from you. You might be requested in order to document your income that have things like shell out stubs, W2s, otherwise tax statements. Other activities you may be wanted can include insurance rates records, bank statements, and you can mortgage statements. That it paperwork is then assessed from the lender’s group out of underwriters to ensure that you qualify for the mortgage.

Leave a Reply